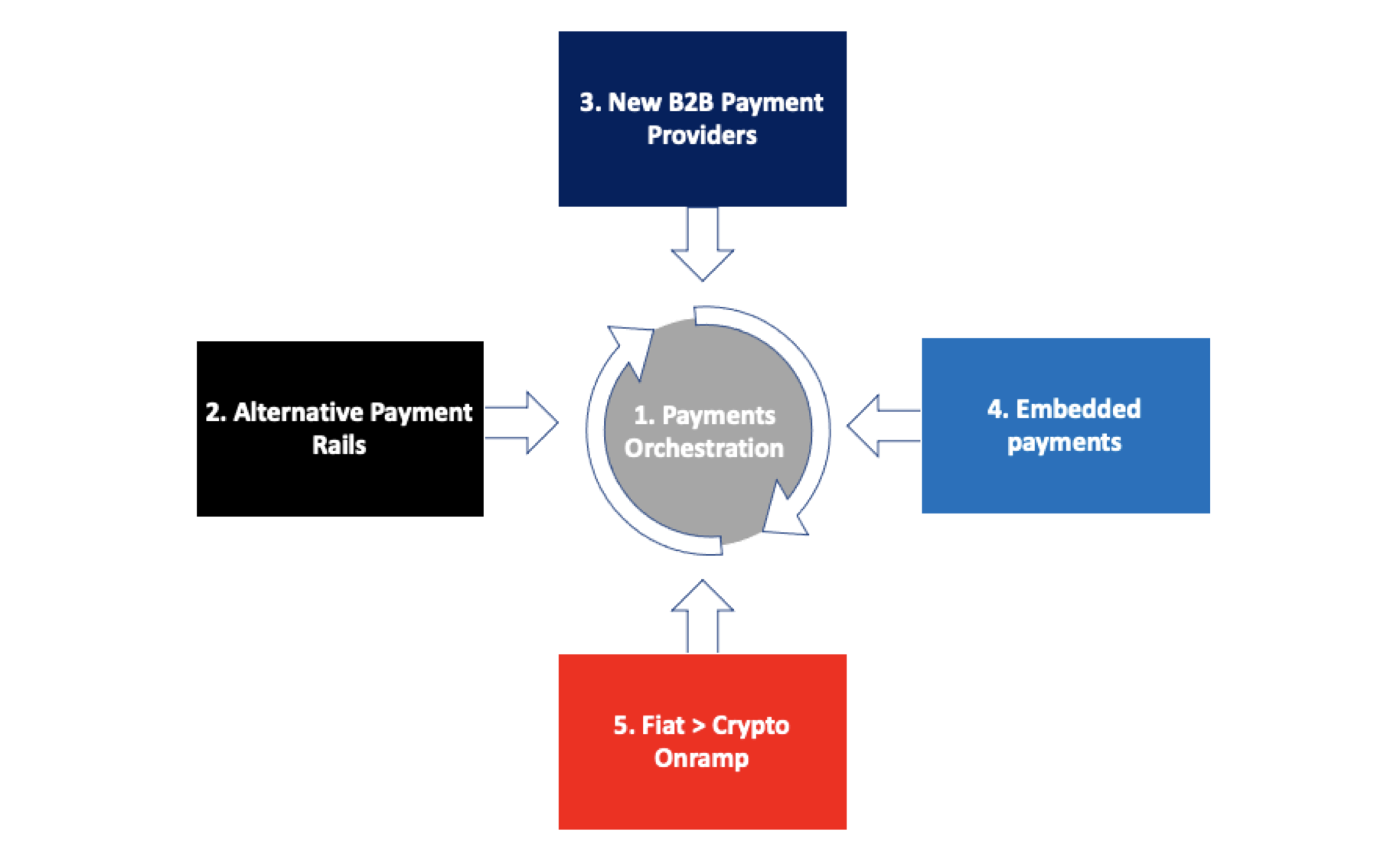

Payments' Five Forces

We’re experiencing a transformational moment in payments…

This past decade, a combination of new technology innovation, regulatory initiatives and evolving consumer behaviours has led to an irreversible shift away from cash towards cards and other digital payment methods. However with the outbreak of Covid in 2020, these longer-term industry shifts have just been supercharged. Consumers are increasingly reliant on and comfortable with online shopping, contactless card payments are becoming the norm, and at-table ordering has helped stimulate new paying behaviours that would otherwise have taken years to adopt.

Don’t get me wrong, we’re still a long way from cash becoming fully redundant, and despite the rise of new payment methods, card payments in mature markets continue to grow. New consumer behaviours, particularly in areas where there is a lot of trust required, take time. But Covid has lit a fire under the industry. We’re at a pivotal moment where the scene is set for new competition and the market is increasingly receptive to new solutions.

In a nod to Michael Porter’s “Five Forces” (and as an ex-consultant, who clearly can’t shake his past), I’ve broken this market disruption within payments into five opportunity areas where Mouro Capital is actively exploring and investing.

1. Payments Orchestration

As the digital economy has expanded, so too has the complexity and fragmentation of online payments. Consumers are increasingly adopting diverse ways to pay (be it PayPal, Buy-Now-Pay-Later, Account-to-Account, etc), resulting in increased requirements for merchants to integrate and support multiple payment methods and providers. Added to this, with more global / cross-border commerce, and a host of Payment Service Providers (PSPs) to choose from in each market, the need for intelligent routing (for instance to optimise for acceptance or cost) has grown significantly.

Payment orchestrators such as Primer and Apexx help solve these issues, by reducing the overhead of managing multiple integrations, helping route the payment to the optimal provider, and ultimately bringing cost efficiencies for the merchant.

2. Alternative Payment Methods

As illustrated by the meteoric rise of Stripe, easy acceptance of card payments has been a key facilitator of the growth in ecommerce. Cards are widely accepted by merchants, universally issued by banks, and despite the fight against fraud, generally trusted by consumers as a payment method online. However, they're expensive for merchants. Multiple participants in the payments stack take their cut, from issuer, to card scheme, to PSP. And if customers want to spread the cost of their purchase over time, credit cards are even more expensive for merchants than debit.

Account-to-Account payments bring the promise of a solution, with providers such as Truelayer (a Mouro Capital portfolio company) helping merchants bypass the card networks and significantly lower their payment costs.

Similarly on the credit side, Buy-Now-Pay-Later firms are offering an alternative way to spread the cost for consumers, again, side-stepping the card schemes. Klarna paved the way in Europe, but a new wave of industry specific alternatives are also being developed, for instance Zaver which offers BNPL for automotive and other durables.

3. New B2B Payment Providers

Compared to consumer payments, B2B payments have historically been lagging behind. The vast majority of B2B payments are still requested manually via an invoice, chased via phone or email when overdue, and then once paid (sometimes even by cheque), manually reconciled against what was billed. This leads to errors, unnecessary cost and sometimes even cash flow issues.

Fortunately, we're seeing a wave of companies trying to solve these challenges, from automating the workflow of sending, requesting and reconciling payments (e.g. Likvido), to enabling Buy-Now-Pay-Later for business payments (e.g. Hokodo).

4. Embedded Payments

From gym management software, to restaurants, to hotels, there are now several very large industry-specific software platforms that sit at the heart of their customers' workflows, offering software specifically tailored to that industry's needs. Many of these platforms initially started with non-fintech use-cases (e.g. scheduling or CRM), but are now moving rapidly into payments as a revenue stream. Legl for instance, helps lawyers accept payments online, tailored to their very specific reporting and workflow requirements.

Under the hood, Stripe Connect has been to-date the dominant provider of such infrastructure, but there are now also newer 'embedded payments' players on the block. Shuttle Global for instance, helps SaaS vendors offer payments to their merchants on their platform, agnostic of PSP. And US fintech Finix helps enable large platforms to become their own facilitator, capturing more of the economics across the payments stack.

5. Fiat <> Crypto Onramp

There's a multitude of reasons behind the success of Coinbase, but one of the most obvious is because they simply made it so easy for crypto newbies to start buying tokens. Coinbase offers a simple, user-friendly experience, and can charge a premium on fees as a result.

In the wider crypto ecosystem, however, significant user friction still remains. With new crypto projects launching each week, increased interest in Decentralised Finance (DeFi), and the most recent explosion of NFTs, there's a big opportunity to replicate the 'UX success' of Coinbase, and build an easy, universal fiat-to-crypto onramp. And this is exactly what companies such as Ramp and Mercuryo are doing.

We’re looking for bold entrepreneurs building the future of payments. If you’re solving problems in these areas, please do get in touch!

Parts of this article originally appeared in Sifted’s Europe’s 17 most promising payments startups, according to investors